When you think about finance, you might picture dull spreadsheets and endless meeting rooms. But hold onto your hats, gents, because the ORNL FCU (Oak Ridge National Laboratory Federal Credit Union) is flipping that narrative on its head. They’re not just throwing money around; they’re crafting a positive impact on communities and enhancing financial literacy—like a superhero for your wallet. Cranking out financial products that do more than just sit on the shelf, ORNL FCU is revolutionizing how we view personal finance while pulling the community along for the ride.

The Role of ORNL FCU in Empowering Local Communities

First things first: ORNL FCU leads the charge in financial literacy, and that’s music to our ears. They’ve teamed up with local schools and organizations—yeah, the kind that give you hope for the future, like the United Way—to host workshops that break down the complexities of budgeting, saving, and credit into bite-sized nuggets of wisdom. Picture yourself in a room filled with young adults, keen to conquer their financial destinies, getting tips straight from the pros, and leaving ready to tackle the world.

This initiative doesn’t just throw folks a life vest; it builds better swimmers. Equipped with knowledge, locals become smarter spenders and savers, ultimately enhancing their economic standings. That’s the kind of community empowerment that gets people talking. Imagine what it feels like to transform from clueless spender to savvy investor—now that’s a flex you can be proud of.

Top 5 Financial Products Offered by ORNL FCU That Change Lives

1. Affordable Home Loans

First up in the ORNL FCU lineup are their affordable home loans. If you’ve ever dreamt of snagging your first house without selling a kidney, you’ll want to check out their First-Time Homebuyer Program. With lower down payments and reduced closing costs, homeownership isn’t just a fantasy for the rich anymore—it’s an achievable reality for families feeling the pinch of rising housing costs.

2. Consolidation Loans

Mounting debt breathing down your neck? Don’t sweat it. ORNL FCU has your back with consolidation loans that help you wrap all those pesky payments into one neat package. Tossing multiple debts into one manageable payment can lower your stress levels and (bonus!) usually comes with a lower interest rate. It’s about taking back control of your finances and moving towards a more stable future.

3. Youth Savings Accounts

Looking to make money-savvy kids? Check out ORNL FCU’s youth savings accounts. Designed to instill financial responsibility from a young age, these accounts dish out higher interest rates and even rewards for reaching those all-important savings goals. They’re planting the seeds of financial wisdom early. Who doesn’t want their kids to grow up rolling in dough?

4. Community-Focused Investment Accounts

Now, this one’s a game changer. With Community Investment Accounts, ORNL FCU has found the sweet spot between personal finance and community development. A part of the interest earned gets funneled back into local projects—think parks and recreational facilities—making you feel like an owner in your neighborhood. Your money helps create a booming community, and who wouldn’t want to be a part of that?

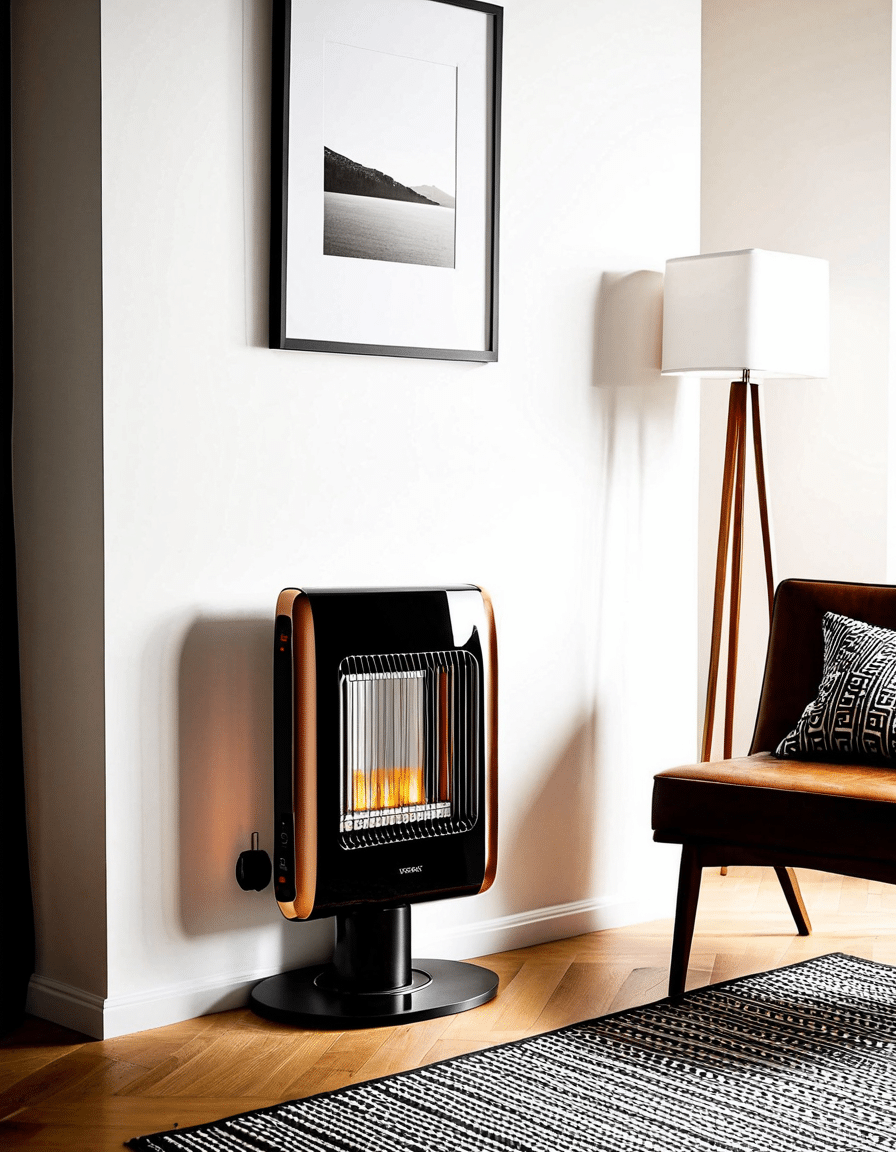

5. Green Loans for Sustainable Infrastructure

In tune with the rising demand for sustainability, ORNL FCU introduces Green Loans specifically designed to fund eco-friendly projects. Want to install solar panels or make energy-efficient upgrades? Jump on the green wagon and reap the benefits of making a positive impact on the planet while boosting your home’s value. With every dollar spent, you contribute to a greener tomorrow. Who knew finance could save the world?

ORNL FCU’s Approach to Financial Crisis Management

When life throws curveballs—like job loss or a health scare—ORNL FCU is right there in your corner. Their crisis management programs don’t just exist on paper; they’re a lifeline for community members facing tough times. The dedicated team at ORNL FCU works directly with affected members, helping them navigate these unpredictable waters.

Through options like temporary loan forbearance and flexible repayment plans, they go the extra mile to assist their members. This isn’t just about money; it’s about people—real folks making real connections when it counts. They step in when you feel like you’re on shaky ground, offering reassurance that you’re not alone in this.

Comparing ORNL FCU with Other Credit Unions: The Community Impact Factor

Let’s get real for a minute. Sure, other credit unions in the area like Knoxville TVA Employees Credit Union offer similar products, but when you stack them up, ORNL FCU shines like a diamond. It’s not just about the loans or interest rates; it’s about the substantial community impact.

When evaluating their offerings, ORNL FCU’s relentless focus on community improvement through workshops and investments shows a commitment that others can only dream of. Their financial products don’t just fill the coffers but aim to uplift entire communities. Now that’s what we call a financial institution with heart!

Success Stories: Lives Changed by ORNL FCU

Stories from the community highlight how ORNL FCU has turned lives around. Meet Sarah Mitchell, a single mother who turned to the credit union’s First-Time Homebuyer Program in her quest for a stable home environment. Thanks to a low-interest rate and some essential financial counseling, she’s now a proud homeowner, kicking financial distress to the curb and establishing her family’s future.

Then there’s James and Maria Lopez, who tackled their financial woes with consolidation loans from ORNL FCU. They combined their debts into one manageable payment, allowing them to breathe a sigh of relief and, more importantly, save for their kids’ education. The relief of stress and financial stability can’t be overstated.

Crafting a Sustainable Future with ORNL FCU

In a financial landscape often dominated by the bottom line, ORNL FCU emerges as a pilot of community enrichment. By focusing on developing innovative products and enhancing financial literacy, they’re paving the way for a new breed of financial institutions. This approach promotes not just economic growth but creates a tightly woven community fabric.

As the years roll on, ORNL FCU’s initiatives will continue driving home the message: finance can be fun, rewarding, and, above all, a means for positive community change. This isn’t just about numbers on a balance sheet; it’s about real lives impacted by thoughtful financial practices. Let’s raise a glass to that—cheers to a brighter, financially savvy future!

Exceptional Trivia about ORNL FCU

Fun Facts That Matter

Did you know ORNL FCU isn’t just a financial institution but also a vibrant community hub? With roots tracing back to 1950, its growth mirrors the local economy’s ups and downs. Interestingly, many members love sharing stories about their experience at ORNL FCU, just like folks share tips on raising adorable bantam chickens or prepping healthy snacks for kids. Both reflect a sense of community that’s fundamental to the credit union’s ethos. ORNL FCU often supports local initiatives, putting members at the forefront of decision-making—much like selecting the perfect laptop bag for women can change one’s daily routine.

Commitment to Health and Education

Beyond finance, ORNL FCU extends its impact into health and education, aiming to foster well-being and knowledge in the community. This dedication is akin to tackling nosocomial infections in healthcare—it’s essential for ensuring everyone thrives. Financial literacy programs are a major component, empowering individuals to take control of their finances. It’s similar to the wisdom of choosing the right bucket seats for your car; making the right choices now leads to greater comfort down the road.

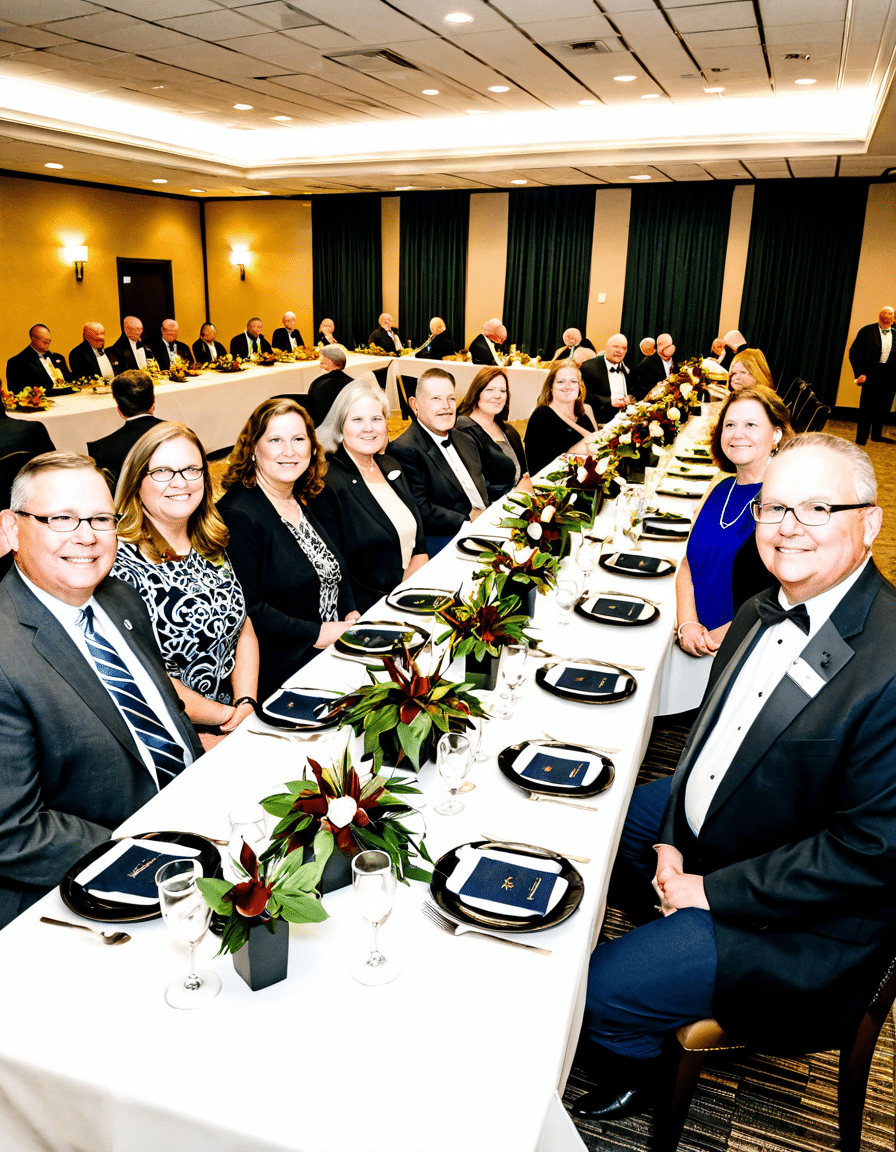

Engaging with the Community

The credit union regularly collaborates with local organizations to enhance community initiatives, spotlighting its commitment to service. Think of it like the camaraderie seen in playful, spirited chats about corbinfisher—enthusiastic exchanges that connect people with shared interests. Additionally, the credit union addresses financial wellness through creative outreach. Just as lighting votive candles can set a mood or bring comfort, ORNL FCU’s programs aim to ignite hope and support in every corner of their community.

With strong roots and a visionary perspective, ORNL FCU exemplifies the notion that finance can have a meaningful impact. Through member collaboration and dedicated initiatives, the organization works tirelessly to uplift those it serves. Whether keeping abreast of DXYZ stock updates or simply enjoying local events, there’s a vibrant narrative unfolding right here, reminding us that financial health and community spirit go hand in hand.